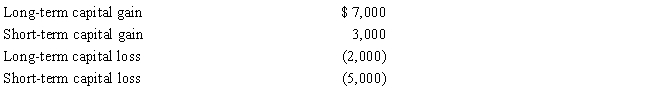

For the current year, Susan had salary income of $20,000. In addition she reported the following capital transactions during the year: There were no other items includable in her gross income. What is the amount of her adjusted gross income for the current year?

Definitions:

High Plateaus

Elevated flat-topped areas of land that rise sharply above the surrounding land on at least one side, often formed by tectonic activities or erosion.

Seafloor Spreading

The process by which new oceanic crust is formed at mid-ocean ridges and slowly moves away from the ridge.

Subduction-related Magmatism

The process of magma generation and volcanic activity that occurs in zones where one tectonic plate is subducted under another.

Continental Collision

The process by which two continental plates collide, leading to the formation of mountains and other geological features.

Q1: Phillip and Naydeen Rivers are married with

Q7: Cows used in a farming business are

Q15: Which one of the following payroll tax

Q25: April and Wilson are married and file

Q50: New York is a community property state.

Q55: Taxpayers are permitted to take an itemized

Q61: For 2015, the maximum amount of expenses

Q71: Casualty and theft losses must be reduced

Q85: Daniel lives in a state that charges

Q104: Joseph exchanged land (tax basis of $34,000),