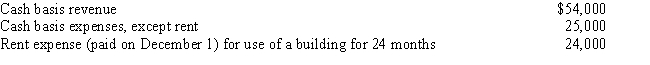

Becky is a cash basis taxpayer with the following transactions during her calendar tax year: What is the amount of Becky's taxable income from her business for this tax year?

Definitions:

Gatekeeper

An individual or entity that controls access to something, such as information or resources, often acting as a barrier to entry or exit.

Itemization

A method of pricing a funeral in which every item of service, facility, and transportation is listed with its related cost. This is the method mandated by the Federal Trade Commission.

Funeral Costs

The expenses associated with conducting a funeral service, including but not limited to, the casket, service fees, burial or cremation, and other associated costs.

Federal Trade Commission

A United States government agency established to prevent anticompetitive business practices, consumer deception, and unfair methods of competition.

Q8: Taxpayers must itemize their deductions to be

Q9: Clay changes jobs in 2015 and decides

Q66: In some cases, a taxpayer may deduct

Q66: If the taxpayer does not maintain adequate

Q79: Agnes is retired and has only a

Q81: Which of the following statements is true

Q93: Curly and Rita are married, file a

Q101: Unreimbursed employee business expenses are miscellaneous itemized

Q102: Edward has business operations in Country F

Q107: Which of the following is not a