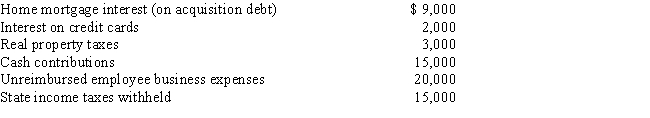

Dan and Maureen file a joint income tax return for 2015. They have two dependent children, ages 7 and 9. Together they earn wages of $152,000. They also receive taxable interest income of $8,000 and interest on City of Los Angeles bonds of $12,000. During 2015, they received a state income tax refund of $3,000 relating to their 2014 state income tax return on which they itemized deductions. Their expenses for the year consist of the following:

Calculate Dan and Maureen's tentative minimum tax liability assuming an exemption amount of $83,400, before any phase-outs. Show your calculations.

Definitions:

Sleep Quality

A measure of how well one sleeps, considering factors such as duration, latency, frequency of disturbances, and feelings upon waking.

Sleep Cycles

The patterns of alternating REM (rapid eye movement) and non-REM sleep that occur cyclically throughout a typical sleep period, affecting overall sleep quality and health.

Siesta Cultures

Societies or communities where taking a midday nap or rest is a common and valued practice.

Midday Napping

A short sleep taken during the day, particularly around the middle of the day, to rest and rejuvenate.

Q1: The taxpayer generally has only 1 year

Q9: Foreign income taxes paid are deductible.

Q16: Richard is employed by a major defense

Q19: An asset's adjusted basis is computed as:<br>A)Original

Q33: If taxpayers fail to provide their bank

Q60: On August 1, 2015, David purchased manufacturing

Q99: The foreign tax credit applies only to

Q100: A scholarship for room and board granted

Q113: Jon, age 45, had adjusted gross income

Q127: Roberto, age 50, has AGI of $110,000