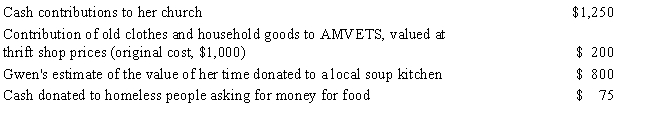

Gwen has written acknowledgments for each of the following charitable contributions during the current year:

What is Gwen's charitable contribution deduction for the current year?

Definitions:

Retail Locations

Physical places where consumers can purchase goods or services directly from a seller.

Corporate Blog

A blog published and maintained by a company to share insights, news, and updates, often as part of its content marketing strategy.

Super Bowl Ad

High-profile advertisements shown during the Super Bowl, often characterized by their increased creativity and production value.

Corporate Blog

A blog created and maintained by a company to share insights, company news, and engage with its customers and stakeholders.

Q4: Karina receives a scholarship of $10,000 to

Q10: When a residence is rented for less

Q14: Individual quarterly estimated tax payments are filed

Q34: If a Section 401(k) plan allows an

Q47: Verlin sells a commercial building and receives

Q52: Glen and Mary have two children, Chad,

Q90: A dependent child with earned income in

Q92: Which of the following sales results in

Q97: Partnerships:<br>A)Are not taxable entities.<br>B)Are taxed in the

Q135: Alicia is a single taxpayer with AGI