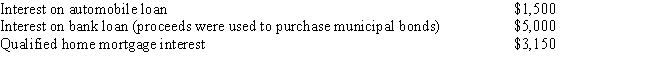

Jerry and Ann paid the following amounts during the current year: What is the maximum amount they can use as interest expense in calculating itemized deductions for the current year?

Definitions:

Pronation

A rotational movement of the forearm that turns the palm downward or backward.

Rotation

The act or process of turning around a center or an axis, a fundamental movement in biomechanics.

Gomphosis

A form of fibrous connection that secures a tooth within its jaw socket.

Syndesmosis

A type of fibrous joint in which bones are joined together by long collagen fibers, allowing for limited movement.

Q7: Answer the following questions regarding the taxability

Q22: During the current year, Mary paid the

Q22: Betty and Steve have a 4-year-old child,

Q51: Warren invested in a limited partnership tax

Q53: Oliver has two employees who earned the

Q72: The value of lodging provided to a

Q88: Mark the correct statement.<br>A)Residential real property is

Q90: Gary is a self-employed accountant who pays

Q95: The office building Donna owned and used

Q105: Net short-term capital gains may be offset