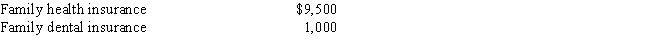

Mike and Rose are married and file jointly. Mike earns $45,000 from wages and Rose reports $450 on her Schedule C as an artist. Since Mike's work does not offer health insurance, Rose pays the following health insurance premiums from her business account:

How much can Mike and Rose deduct as self-employed health insurance?

Definitions:

Cellular Layouts

An arrangement of resources in manufacturing to improve efficiency and communication by grouping different machines based on the sequence of operations.

Coordination

The arrangement of various components of a sophisticated entity or operation in a way that allows them to function in unison efficiently.

Long-linked Technology

Refers to production processes characterized by sequential stages of operations, where the output of one stage becomes the input of the next.

Service Delivery

The act of providing a service to customers or clients, encompassing the processes and activities involved in meeting their needs and expectations.

Q8: To qualify for the moving expense deduction,

Q14: Taxpayers are required by law to maintain

Q16: Jack is a lawyer and Jeri is

Q21: During the current year, Hom donates a

Q50: Carmen owns a house that she rents

Q75: Alan, whose wife died in 2013, filed

Q83: For an expense to qualify as a

Q83: Which one of the following conditions must

Q94: To be depreciated, must an asset actually

Q99: All of the following amounts are excluded