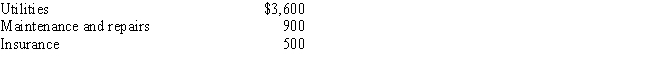

Bill is the owner of a house with two identical apartments. He resides in one apartment and rents the other apartment to a tenant. The tenant made timely monthly rental payments of $550 per month for the months of January through December 2015. The following expenses were incurred on the entire building: In addition, depreciation allocable to the rented apartment is $1,500. What amount should Bill report as net rental income for 2015?

Definitions:

Form 1040EZ

A simplified tax form for individuals with uncomplicated tax situations, no longer in use as of the 2018 tax year.

Interest Income

Income earned from deposit accounts or investments through the receipt of interest.

Dependent

A person, often a child or other family member, whose financial support and well-being are the responsibility of another, often affecting tax deductions.

Litigated Tax Disputes

Tax disagreements that have been brought before a court for resolution.

Q6: Mary is age 33 and a single

Q10: On July 15, 2015, H. P. purchases

Q76: A taxpayer places a $50,000 5-year recovery

Q97: Partnerships:<br>A)Are not taxable entities.<br>B)Are taxed in the

Q98: Sally and Jim purchased their personal residence

Q111: Which of the following is nontaxable income

Q113: Robert works for American Motors. American Motors

Q117: Rob's employer has an accountable plan for

Q121: Christine saw a television advertisement asking for

Q123: The cost of a chiropractor's services qualifies