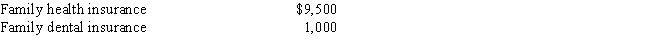

Mike and Rose are married and file jointly. Mike earns $45,000 from wages and Rose reports $450 on her Schedule C as an artist. Since Mike's work does not offer health insurance, Rose pays the following health insurance premiums from her business account:

How much can Mike and Rose deduct as self-employed health insurance?

Definitions:

Demand

The volume of goods or services that purchasers are ready and financially able to acquire at several price points within a certain period.

Supply

The total amount of a product or service that producers are willing and able to sell at a given price level in a given time period.

Exchange Rate

The price at which two different currencies are exchanged, for example, ¥10 to the dollar, or $.010 per yuan.

Exchange Rate

The value of one currency for the purpose of conversion to another, reflecting the international market value of a nation's currency.

Q3: Bonnie receives salary income of $32,000, unemployment

Q6: Which of the following is not an

Q7: The expenses associated with the rental of

Q32: The IRS has approved only two per

Q35: There is a limitation of $25 per

Q50: Taxpayers must report interest income on Series

Q70: In the current year, Johnice started a

Q81: Susie received unemployment benefits in the current

Q104: A corporation is a reporting entity but

Q126: Mark a "Yes" to each of the