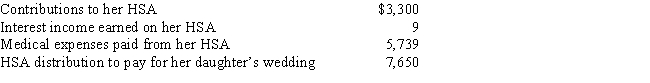

Miki, who is single and 57 years old, has a quaifying high-deductible insurance plan. She had the following transactions with her HSA during the year:

a.How much may Miki claim as a deduction for adjusted gross income?

b.What is the amount that Miki must report on her tax return as income from her HSA?

c.How much is subject to a penalty? What is the penalty percentage?

Definitions:

Gross Domestic Product

The total market value of all finished goods and services produced within a country in a specific time period.

Illegal Goods

Products or services that are prohibited by law from being produced, traded, or consumed.

Depletion of Natural Resources

The consumption of natural resources faster than they can be replenished, leading to a reduction in their availability over time.

Nominal Gross Domestic Product

The total market value of all final goods and services produced in a country in a given period, measured in current prices without adjusting for inflation.

Q19: What income tax form does a self-employed

Q28: Bennett purchased a tract of land for

Q34: The Wage and Investment Office of the

Q43: If a taxpayer installs special equipment in

Q89: Taxpayers must use the straight-line method of

Q92: An individual, age 22, enrolled on a

Q93: If a taxpayer sells his personal residence

Q96: Jerry and Sally were divorced under an

Q98: In all community property states, income from

Q105: Jim, a single individual, was unemployed for