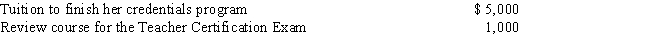

Natasha is a self-employed private language tutor. In 2015, she obtained her teaching credentials, hoping to receive a job as a seventh grade public school English teacher. She had the following education expenses for the year:

Natasha also attended a seminar in Washington, D.C., titled "The Motivated Student." Her expenses for the trip are as follows:  Determine how much of the above expenses are deductible on her Schedule C.

Determine how much of the above expenses are deductible on her Schedule C.

Definitions:

Eye Contact

The act of looking directly into another person's eyes, often signaling engagement, confidence, or sincerity.

Environmental Campaigner

An individual actively involved in promoting and advocating for the protection of the environment.

Project Milestones

Significant events or points in time within a project that signify important achievements or phases.

Topgrading

A recruitment approach aimed at ensuring companies hire and retain only the highest-performing employees.

Q18: Fran bought stock in the FCM Corporation

Q30: Peter is required by his divorce agreement

Q45: Janine is a sole proprietor owning a

Q60: On July 1, 2015, Robert forms the

Q73: Which of the following is not deductible

Q76: The adjusted gross income (AGI) limitation on

Q80: Dr. J's outstanding player award is not

Q93: Curly and Rita are married, file a

Q95: A gift received from a financial institution

Q102: Mike purchased stock in MDH Corporation 5