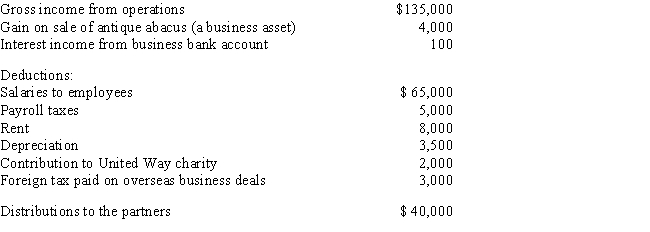

J. Bean and D. Counter formed a partnership. During the current year, the partnership had the following income and expenses:

a.Calculate the net ordinary income.

b.List all of the other items that need to be separately reported.

c.If the partnership is on a calendar year tax basis, when is the partnership tax return due?

Definitions:

Statute

A written law passed by a legislative body at the federal or state level that governs and dictates actions.

Normandy

A geographic region in France, known for its historical events, especially the D-Day invasion during World War II.

Natural Law

A theory asserting that certain rights or values are inherent by virtue of human nature and universally cognizable through human reason.

Legal School

An institution or environment dedicated to the education and training of individuals in the field of law.

Q11: The Domain Name System (DNS) converts IP

Q31: During the 2015 holiday season, Bob, a

Q36: To analyze unstructured data, such as memos

Q36: Corporations may be subject to the alternative

Q40: Interest earned on bonds issued by a

Q42: Which of the following taxpayers will benefit

Q48: The network standard for connecting desktop computers

Q62: Curt's tax client, Terry, is employed at

Q67: VoIP technology delivers video information in digital

Q84: List two general objectives of the tax