You Make the Call-Situation 2

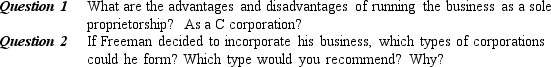

Matthew Freeman started a business in 1993 to provide corporate training in project management. He initially organized his business as a sole proprietorship. Until 1999, he did most of his work on a contract basis for Corporation Education Services (CES). Under the terms of his contract, Freeman was responsible for teaching 3- to 5-day courses to corporate clients-primarily Fortune 1000 companies. He was compensated according to a negotiated daily rate, and expenses incurred during a course (hotels, meals, transportation, etc.) were reimbursed by CES. Although some expenses were not reimbursed by CES (such as those for computers and office supplies), Freeman's expenses usually amounted to less than 1 percent of his revenues.

In 1999, Freeman increasingly found himself working directly with corporate clients rather than contracting with CES. Over the years, he had considered incorporating but had assumed the costs and inconveniences of this option would outweigh the benefits. However, some of his new clients said that they would prefer to contract with a corporation rather than with an individual. And Freeman sometimes wondered about potential liability problems. On the one hand, he didn't have the same liability issues as some other businesses-he worked out of his home, clients never visited his home office, all courses were conducted in hotels or corporate facilities, and his business involved only services. But he wasn't sure what would happen if a client were dissatisfied with the content and outcomes of his instruction. Finally, he wondered whether there would be tax advantages to incorporating.

Definitions:

Flow

A state of intense focus and immersion in activities, where individuals lose sense of time and self, often leading to high levels of productivity and creativity.

Elitist

a term used to describe a person or class of people considered to be superior to others, often in terms of intellect, wealth, or social status.

Maslow's Theory

A psychological theory proposing a hierarchy of five categories of human needs, from basic physiological needs to safety, love and belonging, esteem, and finally, self-actualization.

Jonah Complex

The fear of success or the avoidance of one's potential greatness, leading to self-doubt and the suppression of talent.

Q7: Plans that appeal effectively to investors are<br>A)

Q8: Even if family members lack the capability

Q12: Irene Anderson, an experienced entrepreneur, is evaluating

Q17: In a family business, the interests of

Q23: The death of the sole proprietor terminates

Q25: The executive summary part of a business

Q39: What is the proper order of the

Q43: You Make the Call-Situation 4<br>Watch your older

Q51: Winston Wolfe believes it is important to

Q75: All other factors being equal, retail and