You Make the Call-Situation 1

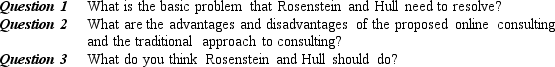

When they created Round Table Group (RTG) Inc., Russ Rosenstein and Robert Hull envisioned a company offering one-stop shopping for intellectual expertise. They wanted to help businesspeople, management consultants, and litigation attorneys get answers to important questions from top-notch thinkers anywhere in the world through the Internet.

RTG's plan was to have a kind of SWAT team of professors who would answer questions based on their expertise. A team might consist of one or two professors, who would communicate with the client via e-mail, phone, or videoconferencing on projects that might involve a few hours or a few weeks of input. In the traditional management-consulting model, work on a project often lasts as long as a couple of years, and the team consists of a group of junior analysts, managers, and partners.

RTG assembled a database made up mainly of 3,000 university professors available to consult on an as-needed basis. The firm's fixed costs would be low because the professors would be paid only when they did billable work. But an unexpected wrinkle soon emerged. RTG's customers wanted RTG to start acting more like a traditional consulting firm. Business executives wanted face-to-face contact with the professors giving the information. They also wanted number crunching and follow-up analysis. And they wanted current, customized research.

That has left RTG at a crossroads. Should it try to become a more traditional management-consulting firm or continue to pursue its original mission of providing advice through Internet content and virtual links?

Taking the first path would mean providing support to clients, adding infrastructure and formalizing its operation by dividing it into distinct specialties. That would have the downside of making RTG's competitive point of differentiation murky. But the second path would risk putting off clients who say they want more.

(Source: Elena De Lisser, "A Plan May Look Good, but Watch Out for the Real World," Startup Journal, The Wall Street Journal Online, http://www.startupjournal.com/howto/management/199908240948-lisser.html, January 15, 2004.)

Definitions:

Cephalic Vein

A large vein on the outer side of the upper arm, draining blood from the hand and forearm into the shoulder's subclavian vein.

External Jugular Vein

A vein located on the outside of the neck that drains blood from the head, neck, and upper chest into the superior vena cava.

Radial Vein

A vein that accompanies the radial artery and drains blood from the lateral portion of the forearm.

Forelimb

The front limbs of an animal that in humans refer to the arms, including structures from the shoulder to the fingers.

Q5: Which of the following statements about observational

Q10: Max Baer chose to operate his production

Q24: Identify the various users of business plans

Q49: Individuals who have entered business as a

Q63: An active board of directors serves management

Q76: Adopting a consumer-oriented marketing philosophy is most

Q77: Unlike employees in small firms, those who

Q85: Experience has shown that an effective plan

Q87: Concerning the need for good management in

Q99: To maximize sales and profits, a discount