You Make the Call-Situation 1

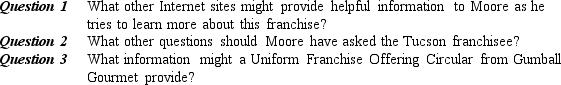

Ethan Moore is a college student in Phoenix, Arizona, currently enrolled as an entrepreneurship major. Moore's home is in Chandler, Arizona, a nearby city where he is considering purchasing a franchise. The franchise caught his interest while he was on a shopping trip to the Tucson Mall, and is operated by an Idaho-based gumball company named Gumball Gourmet.

Moore talked to the owner of the franchise at the Mall while he was stocking the kiosk, which is set up in three tiers with 47 gumball machines and a money changer. The owner mentioned in their brief conversation that this particular kiosk had sold 12,000 gumballs in the last 30-day period.

From information he found at the Gumball Gourmet Web site, Moore determined that franchises are available with as little as a $25,000 investment.

(Source: http://www.gumballgourmet.com, September 2003.)

Definitions:

Treynor's Measure

A performance metric for determining how well an investment portfolio has compensated the investor for the risk taken, using beta as the risk measure.

Risk-Free Return

The theoretical return on an investment with zero risk, typically represented by government bonds or bills, serving as a benchmark for assessing investment performance.

Information Ratio

This ratio measures the excess return of a portfolio over the benchmark's return, relative to the volatility of those excess returns, indicating the portfolio manager's ability to generate consistent excess returns.

Risk-Free Return

The theoretical return on investment with no risk of financial loss, often represented by the yield on government securities.

Q9: Business guru Peter Drucker stated "Innovation is

Q28: Outline the "best practices" for the management

Q31: Reciprocation is<br>A) responding to competitor's marketing efforts<br>B)

Q33: The vast majority of bloggers earn around

Q47: The role of the entrepreneur's spouse in

Q52: Most entrepreneurs exercise great integrity, but some

Q55: Once the decision is made to prepare

Q77: Partners always share profits and losses equally.

Q85: Zoning ordinances<br>A) may limit what type of

Q106: Any weakness in the management of a