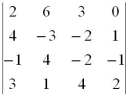

Evaluate the determinant below.

Definitions:

Schedule D

A form used with a tax return to report capital gains and losses incurred during the reporting period.

Involuntary Conversions

Events where property or assets are destroyed, stolen, condemned, or disposed of under the threat of condemnation and the owner is compensated, with potential tax implications.

Amended Tax Return

A tax return filed to correct inaccuracies or add new information to a previously filed return, often resulting in a different tax liability.

Replacement Period

The specified time frame within which property must be replaced to defer recognition of gains for tax purposes.

Q2: What is the best imaging examination to

Q14: What pathology can cause a mediastinal shift

Q22: Diseases caused by the disturbance of normal

Q27: The linear programming model of the production

Q29: A basic feasible solution is a solution

Q34: When using the normal distribution to approximate

Q36: Which of the following techniques can be

Q82: To solve the following set of simultaneous

Q89: What does the C<sub>j</sub> - Z<sub>j</sub> row

Q110: In the maximal-flow technique,a zero (0)means no