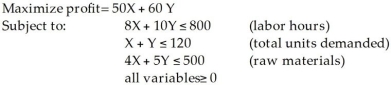

Two models of a product - Regular (X) and Deluxe (Y) - are produced by a company.A linear programming model is used to determine the production schedule.The formulation is as follows:  The optimal solution is X = 100,Y = 0. How many units of the regular model would be produced based on this solution?

The optimal solution is X = 100,Y = 0. How many units of the regular model would be produced based on this solution?

Definitions:

Trading Securities

These are debt or equity securities that are purchased primarily for selling in the near term with the intent of generating short-term profits.

Held-to-maturity Securities

Debt securities which a company has the positive intent and ability to hold until maturity.

Debt Securities

Financial instruments representing money borrowed that must be repaid, typically with interest, such as bonds, bills, or notes.

Equity Securities

Equity securities are financial instruments that represent ownership in a company, such as stocks, giving holders the right to a proportion of the company’s profits.

Q7: The optimal solution to this linear program

Q38: If variable cost/unit falls,the fixed cost rises,and

Q43: An electronics company is looking to develop

Q49: Given the following opportunity loss function,determine the

Q64: A TIME SERIES forecasting model in which

Q67: The H.A.L.Computer Store sells a printer for

Q71: Describe a matrix.

Q86: For the single-period model,if marginal loss increases

Q116: The SSR indicates how much of the

Q128: Errors are also called residuals.