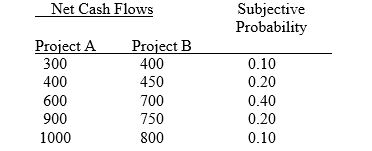

Given the following data on two one period capital projects, calculate 1) the expected value of each project's cash flows and 2) the standard deviation of probable cash flows from each project. Indicate which of the two projects would be chosen by a risk-averse decision maker if their prices were the same and they had similar lives.

Definitions:

Traditionally

In a way that follows long-established customs, beliefs, or methods.

James Marcia

A developmental psychologist known for his work on adolescent identity formation and his theory of identity statuses.

Identity Diffusion

A status in identity development where an individual hasn’t committed to an identity and lacks direction, often characterized by a lack of personal investment and decision-making.

Moratorium

A period of delay or suspension, often used in developmental psychology to describe a period where an individual delays making decisions about identity or career.

Q1: An efficient portfolio is a project or

Q3: An event set consists of all elementary

Q8: Supply's growing involvement in the acquisition of

Q16: Supply should constantly strive to standardize:<br>A)capital equipment

Q23: In a market that is characterized by

Q26: Since, over the long run, there would

Q45: Suppose that a firm is operating under

Q51: One of the pitfalls of cost-benefit analysis

Q55: Suppose that a firm is operating under

Q62: An equilibrium price is one that equates