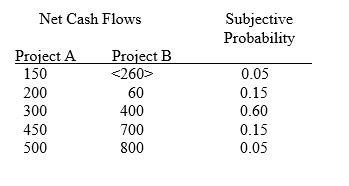

Given the following data on two one period capital projects, calculate 1) the expected value of each project's cash flows and 2) the standard deviation of probable cash flows from each project. Indicate which of the two projects would be chosen by a risk-averse decision maker if their prices were the same and they had similar lives.

Definitions:

Interest Payments

Payments made to lenders as compensation for borrowing money, typically calculated as a percentage of the principal amount.

Bondholders

Bondholders are individuals or entities that hold debt securities issued by corporations or governments, entitling them to receive fixed interest payments and the return of the bond's principal upon maturity.

Market Rate

The prevailing interest rate available in the marketplace for securities or loans, which varies based on demand, supply, and economic conditions.

Bond Interest

The periodic payment made to bondholders, typically a fixed rate of interest paid on the bond's face value.

Q4: The following table shows worker, quantity of

Q14: The most fundamental question facing an organization

Q17: Internal failure costs include the costs of

Q19: Given the following table, Nancy's Nook has

Q24: Marine transport is best suited for products

Q26: Since, over the long run, there would

Q29: Markup on price is the proportion of

Q30: A risk-neutral investor will choose the riskier

Q31: Historical costs are those costs of production

Q38: Becky's Bookshelves currently sells 50 bookshelves a