Use the following information for Questions 10, 11 and 12

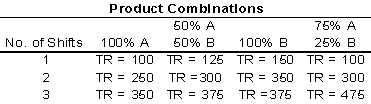

A company that produces breakfast cereal using a highly automated packaging process has the following production and revenue alternatives for three products A, B, and C) that are feasible to produce with existing plant and equipment. Total revenue is in thousands of dollars per month. Total cost for the first shift is $90,000 per month - of which $60,000 is labor, $20,000 is other variable costs, and $10,000 is fixed cost. As the number of shifts is increased, fixed cost remains at $20,000 per month while variable costs other than labor remain the same per shift. For the second shift, labor must be paid 1.3 times the amount paid on the first shift. For the third shift, labor must be paid 1.5 times what it receives in the first shift.

-Profit will be maximized at which of the following product combinations and number of shifts?

Definitions:

Supplies

Materials or items which are used in the operation of a business or needed in the production process.

Services

Economic activities that are intangible, are not stored, and do not result in ownership transfer from the service provider to the service receiver.

Double-Entry

An accounting principle where every transaction is entered twice, as a debit in one account and a credit in another, to keep the accounting equation balanced.

Accounting Equation

The fundamental principle of accounting that represents the relationship between assets, liabilities, and owner's equity: Assets = Liabilities + Owner's Equity.

Q14: If the percentage increase in a firm's

Q17: Suppose that a typical firm in a

Q19: A firm has the following sales data

Q20: When a specification is widely known,commonly recognized

Q29: In most organizations,supply-operations coordination is essential to:<br>A)outsourcing.<br>B)operational

Q30: A risk-neutral investor will choose the riskier

Q34: In a monopsonistic input market the marginal

Q46: City Council member Connie Jefferson has proposed

Q66: Short-run average variable cost is equal to

Q67: Suppose an oligopoly firm has the the