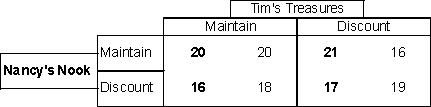

Given the following tables, Nancy's Nook has a dominated strategy.

Definitions:

Tax Rate Structure

The framework defining how different levels of income are taxed at various rates, often progressive, where higher income incurs higher tax rates.

Progressive

A tax system in which the tax rate increases as the taxable amount increases, placing a larger burden on those who have higher incomes.

Proportional

A tax system where the tax rate remains constant as the taxable amount increases.

Regressive

A tax system where the tax rate decreases as the taxable amount increases, leading to lower-income individuals bearing a proportionally higher tax burden.

Q1: The application of pressure on a supplier

Q2: The ratio of total purchases to sales

Q10: Given the following tables, Nash equilibrium occurs

Q12: A process is a set of activities

Q16: When a firm is practicing price discrimination

Q23: Backwards induction is the process of tracing

Q29: Monopsonistic competition is the term we use

Q37: An isoquant is a contour line that

Q38: The variance, a measure of the dispersion

Q58: In a monopoly, if price is greater