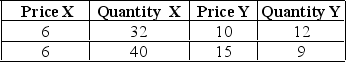

Based on the following price and quantity demanded information for goods X and Y, these goods are complementary goods.

Definitions:

Straight-Line

A method of calculating depreciation or amortization by dividing the difference between an asset's cost and its salvage value by the number of years it is expected to be used.

Depreciation Expense

The allocation of the cost of a tangible asset over its useful life, reflecting wear and tear, deterioration, or obsolescence.

Capital Expenditures

Money spent by a firm on buying or improving hard assets such as land, factories, or equipment.

Revenue Expenditures

Expenses that are immediately charged against revenues in the same accounting period, generally related to the maintenance and repair of fixed assets or operating expenses.

Q5: Costs that are fixed over some ranges

Q5: Franie's Futons currently sells 55 futons a

Q24: Given the demand function Q<sub>X</sub> = 1500

Q29: The lack of entry into a monopolistic

Q31: In a market that is characterized by

Q36: A firm's short run marginal cost is

Q81: When a respiratory therapist saw an article

Q81: "Driving an 18-wheel truck eight hours a

Q96: A casket salesperson who is only allowed

Q111: Given the demand function Q<sub>X</sub> = 5,000