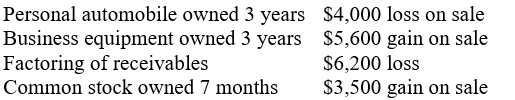

An individual taxpayer has the following property transactions during the current year:

How do these transactions affect the individual's AGI?

Definitions:

Cost Pools

A method used in cost accounting to group collected costs, which simplifies allocating costs to different products, services, or departments.

Activity Rates

Predetermined rates used in activity-based costing to allocate costs to products or services based on their consumption of activities.

Direct Labor Hours

The total hours worked by employees directly involved in the manufacturing process or providing services, used in calculating production costs or rates.

Product-level Costs

Costs that can be directly attributed to a specific product, including materials and direct labor costs.

Q8: On June 20,2015 Baker Corporation (a calendar-year

Q9: Which of the following is an indication

Q18: Brent sold his personal car and some

Q18: A taxpayer can elect to expense immediately

Q34: Corinne's primary business is writing music.She uses

Q35: Describe the concept of an "integrated supply

Q51: Weilin's gross estate was valued at $4,870,000

Q56: What is the purpose of the Health

Q75: How may an S election terminate?

Q84: A fiduciary tax return is filed by<br>A)a