Use the case below to answer the following question(s) .

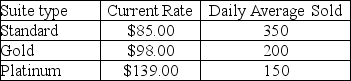

The Tipton Hotel is considering a major remodeling effort and needs to determine the best combination of rates and suite sizes to maximize revenues.Currently,the hotel has 755 suites with the following history:  Each market segment has its own price/demand elasticity.Estimates are:

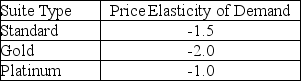

Each market segment has its own price/demand elasticity.Estimates are:  This means,for example,that a 1% decrease in the price of a standard suite will increase the number of suites sold by 1.5%.Similarly,a 1% increase in the price will decrease the number of suites sold by 1.5%.For any pricing structure (in $) ,the projected number of suites of a given type sold (we will allow continuous values for this problem) can be found using the formula:

This means,for example,that a 1% decrease in the price of a standard suite will increase the number of suites sold by 1.5%.Similarly,a 1% increase in the price will decrease the number of suites sold by 1.5%.For any pricing structure (in $) ,the projected number of suites of a given type sold (we will allow continuous values for this problem) can be found using the formula:

(Historical average number of suites sold) + (Elasticity) (New price - Current price) (Historical average number of suites sold) /(Current price)

The hotel owners want to keep the price of a standard suite between $70 and $90; a gold suite between $90 and $110; and a platinum suite between $120 and $149.

Define S = price of a standard suite,G = price of a gold suite,and P = price of a platinum suite.

-What is the new price of a single gold suite,using Solver?

Definitions:

Risk of Loss

denotes the possibility that an asset or investment's value will decrease, reflecting the chance of losing on an investment or possession.

Contract Voided

A legal declaration that a contract is null and void and, therefore, unenforceable as though it never existed.

Partial Inability

A condition where an individual or entity is limited in some capacity but is not completely incapacitated.

Performance Impracticable

A doctrine under which a party may be released from a contract due to the occurrence of unforeseen events making performance impossible or extremely burdensome.

Q14: What is the employer contribution at the

Q16: Cam is using a postmodern perspective to

Q34: The constraint for 16-inch rolls is formulated

Q38: Explain how to fit distributions with Crystal

Q50: What is the cumulative net profit generated

Q66: How would sociologists study such topics as

Q68: Public issues are matters beyond an individual's

Q83: Discuss the flying geese model of development.Provide

Q113: What would a functionalist call the undesirable

Q137: Which of the following is exemplified by