Use the table below to answer the following question(s) .

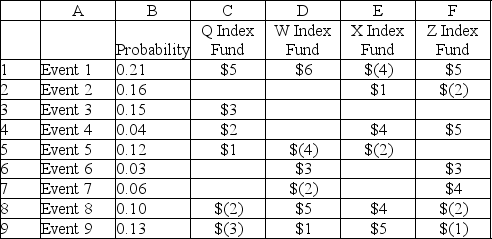

Below is a spreadsheet for a situation in which a day trader wants to decide on investing $200 in one of the index funds.  Answer the following questions using PHStat.

Answer the following questions using PHStat.

-What is the variance of the X index fund?

Definitions:

Zero-Coupon Bond

A debt security that does not pay interest but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full face value.

Coupon Rate

A bond's yearly interest payout rate, described as a percentage of its face value.

Coupon Rate

The annual interest rate paid on a bond's face value, indicating the amount of periodic payments to the bondholder.

TIPS Bond

Treasury Inflation-Protected Securities are U.S. government bonds that are indexed to inflation in order to protect investors from the negative effects of rising prices.

Q4: Which of the following formulas is used

Q19: In the double forecasting model F<sub>t </sub><sub>+

Q22: For the given data,the value of the

Q23: Which of the following is an automated

Q28: To construct and use any control chart,first

Q53: What is the coefficient of variation of

Q69: What is the cumulative net profit generated

Q71: The number of television sets shipped from

Q87: An individual is indifferent between receiving a

Q94: Holt-Winters' forecasting models are examples of qualitative