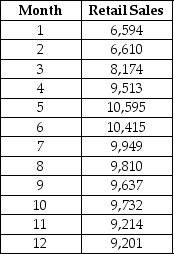

TABLE 16-13

Given below is the monthly time-series data for U.S.retail sales of building materials over a specific year.  The results of the linear trend,quadratic trend,exponential trend,first-order autoregressive,second-order autoregressive and third-order autoregressive model are presented below in which the coded month for the 1st month is 0:

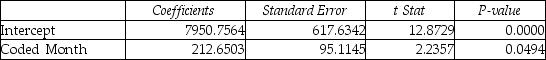

The results of the linear trend,quadratic trend,exponential trend,first-order autoregressive,second-order autoregressive and third-order autoregressive model are presented below in which the coded month for the 1st month is 0:

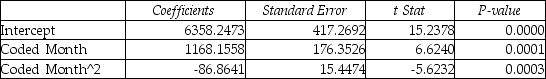

Linear trend model:  Quadratic trend model:

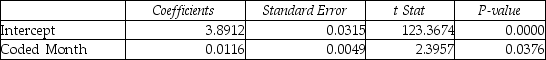

Quadratic trend model:  Exponential trend model:

Exponential trend model:  First-order autoregressive:

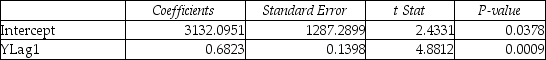

First-order autoregressive:  Second-order autoregressive:

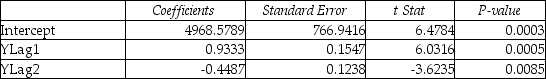

Second-order autoregressive:  Third-order autoregressive:

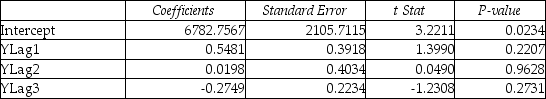

Third-order autoregressive:  Below is the residual plot of the various models:

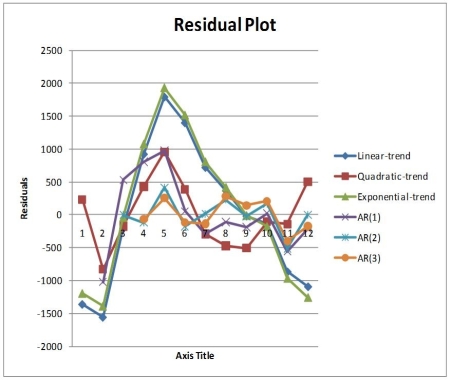

Below is the residual plot of the various models:

-Referring to Table 16-13,what is the exponentially smoothed value for the 12th month using a smoothing coefficient of W = 0.25 if the exponentially smooth value for the 10th and 11th month are 9,477.7776 and 9,411.8332,respectively?

Definitions:

Real GDP

Gross Domestic Product (GDP) adjusted for inflation, measuring the value of goods and services produced by a country in a year, expressed in real terms.

Average Price Level

The average price level refers to the general level of prices for goods and services in an economy over a given period, often used as an indicator of inflation.

Monetary Policy

The process by which the central bank or monetary authority of a country controls the supply of money, often targeting an inflation rate or interest rate to ensure economic stability and growth.

Federal Reserve

The central bank of the United States, responsible for monetary policy, regulating banks, maintaining financial stability, and providing financial services.

Q3: Referring to Table 18-9,an <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2970/.jpg" alt="Referring

Q16: Referring to Table 16-16,what is the unweighted

Q58: Referring to Table 14-10,to test the significance

Q76: Data on the amount of money made

Q121: Referring to Table 17-8,which of the following

Q144: Referring to Table 16-4,exponential smoothing with a

Q200: True or False: Referring to Table 17-10,Model

Q248: Referring to Table 14-16,which of the following

Q264: True or False: A regression had the

Q306: Referring to Table 14-3,to test for the