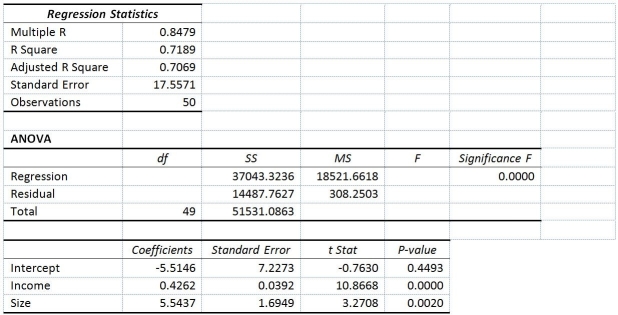

TABLE 14-4

A real estate builder wishes to determine how house size (House) is influenced by family income (Income) and family size (Size) .House size is measured in hundreds of square feet and income is measured in thousands of dollars.The builder randomly selected 50 families and ran the multiple regression.Partial Microsoft Excel output is provided below:  Also SSR (X1 ∣ X2) = 36400.6326 and SSR (X2 ∣ X1) = 3297.7917

Also SSR (X1 ∣ X2) = 36400.6326 and SSR (X2 ∣ X1) = 3297.7917

-Referring to Table 14-4,when the builder used a simple linear regression model with house size (House) as the dependent variable and family size (Size) as the independent variable,he obtained an r2 value of 1.25%.What additional percentage of the total variation in house size has been explained by including income in the multiple regression?

Definitions:

Expenses Paid

Refers to the outflow of cash or other valuable assets from a person or company to another entity in exchange for goods or services.

Assets

Resources owned or controlled by a business from which future economic benefits are expected.

Salaries Expense

The total amount spent by a business on salaries for its employees during a specific period, typically reported on the income statement.

Service Fees Earned

Income recognized by a company for services it has provided to clients.

Q1: If a group of independent variables are

Q41: True or False: Referring to Table 17-12,the

Q42: True or False: Collinearity is present if

Q97: Referring to Table 13-2,to test whether a

Q107: True or False: Referring to Table 14-16,the

Q124: Referring to Table 13-4,the managers of the

Q185: Referring to Table 14-16,what is the p-value

Q221: Referring to Table 17-12,what should be the

Q223: True or False: Referring to Table 17-10,Model

Q309: In a multiple regression model,which of the