TABLE 14-8

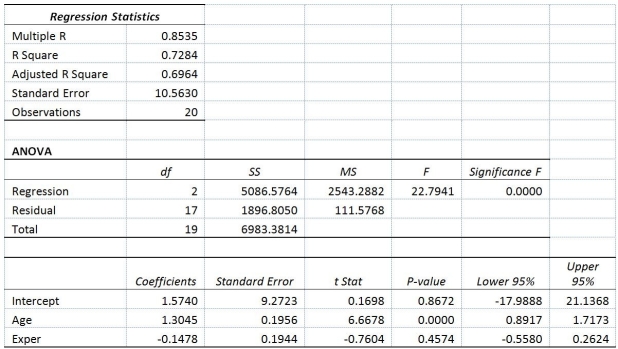

A financial analyst wanted to examine the relationship between salary (in $1,000)and 2 variables: age

(X1 = Age)and experience in the field (X2 = Exper).He took a sample of 20 employees and obtained the following Microsoft Excel output:  Also,the sum of squares due to the regression for the model that includes only Age is 5022.0654 while the sum of squares due to the regression for the model that includes only Exper is 125.9848.

Also,the sum of squares due to the regression for the model that includes only Age is 5022.0654 while the sum of squares due to the regression for the model that includes only Exper is 125.9848.

-Referring to Table 14-8,the value of the partial F test statistic is ________ for

H0 : Variable X2 does not significantly improve the model after variable X1 has been included

H1 : Variable X2 significantly improves the model after variable X1 has been included

Definitions:

Net Income

Net income is the total earnings of a company after subtracting all expenses, taxes, and losses, indicating the company's profitability during a specific time period.

Fair Value

The amount it would take to sell an asset or transfer a liability in a regulated deal between parties in the market at the time of evaluation.

Operating Income

Earnings from a company's core business operations, excluding deductions of interest and taxes.

Initial Value Method

An accounting method that records an investment at its original cost without adjusting for changes in market value or the investee's earnings, except to recognize impairments.

Q26: True or False: The MAD is a

Q27: True or False: Referring to Table 13-12,you

Q40: True or False: Referring to Table 14-7,the

Q102: True or False: Referring to Table 14-15,there

Q114: True or False: Referring to Table 14-17,we

Q154: Referring to Table 14-2,for these data,what is

Q176: Referring to Table 13-4,the standard error of

Q207: Referring to Table 13-2,what is <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2970/.jpg"

Q219: True or False: Referring to Table 14-15,you

Q304: Referring to Table 14-18,what is the estimated