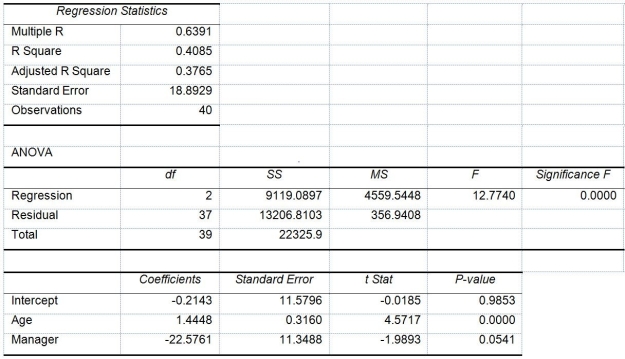

TABLE 14-17

Given below are results from the regression analysis where the dependent variable is the number of weeks a worker is unemployed due to a layoff (Unemploy)and the independent variables are the age of the worker (Age)and a dummy variable for management position (Manager: 1 = yes,0 = no).

The results of the regression analysis are given below:

-True or False: Referring to Table 14-17,the null hypothesis H0 : β1 = β2 = 0 implies that the number of weeks a worker is unemployed due to a layoff is not related to one of the explanatory variables.

Definitions:

Cost of Debt

The effective rate that a company pays on its current debt, incorporating both interest payments and any other required repayments.

Cost of Equity

The return that investors require for their investment in shares, representing the compensation for taking on the risk of investing in equity.

M&M Proposition I

M&M Proposition I, under the Modigliani-Miller theorem, states that in an ideal market, the value of a firm is not affected by how it is financed, whether through debt or equity.

Homemade Leverage

A strategy whereby investors adjust the financial leverage of their investment by borrowing or lending money on their own, rather than relying on the leverage inherent in their investments.

Q1: The degrees of freedom for the F

Q11: True or False: Referring to Table 12-19,what

Q23: Referring to Table 12-10,for the cell with

Q30: Referring to Table 16-12,the best interpretation of

Q32: Referring to Table 12-1,if the firm wanted

Q36: True or False: Referring to Table 15-3,suppose

Q52: True or False: One of the consequences

Q85: Based on the residual plot below,you will

Q218: Referring to Table 14-5,one company in the

Q319: True or False: Referring to Table 14-7,the