TABLE 14-19

The marketing manager for a nationally franchised lawn service company would like to study the characteristics that differentiate home owners who do and do not have a lawn service.A random sample of 30 home owners located in a suburban area near a large city was selected; 11 did not have a lawn service (code 0)and 19 had a lawn service (code 1).Additional information available concerning these 30 home owners includes family income (Income,in thousands of dollars)and lawn size (Lawn Size,in thousands of square feet).

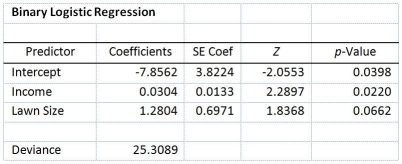

The PHStat output is given below:

-True or False: Referring to Table 14-19,there is not enough evidence to conclude that the model is not a good-fitting model at a 0.05 level of significance.

Definitions:

Depreciation Rate

The percentage or method used to calculate the decrease in value of an asset over time due to use, wear and tear, or obsolescence.

FIFO Approach

A method of inventory valuation where the first items put into inventory are the first ones to be recorded as sold.

Sum-Of-The-Years'-Digits Method

A depreciation technique that results in a more accelerated write-off of an asset over its useful life, by applying a decreasing fraction to its depreciable cost.

Repairs

Expenditures that restore an asset to its previous operating condition or maintain the asset in its current condition, without significantly enhancing its value.

Q13: True or False: A simple price index

Q63: Referring to Table 13-4,the total sum of

Q69: Referring to Table 14-7,the department head wants

Q83: True or False: Referring to Table 13-11,there

Q103: Referring to Table 14-15,which of the following

Q130: True or False: Referring to Table 12-5,there

Q147: Referring to Table 12-14,the calculated value of

Q159: Referring to Table 14-5,which of the independent

Q168: True or False: Referring to Table 12-11,the

Q213: True or False: The coefficient of determination