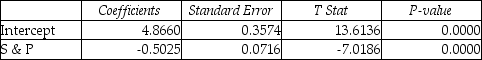

TABLE 13-7

An investment specialist claims that if one holds a portfolio that moves in the opposite direction to the market index like the S&P 500,then it is possible to reduce the variability of the portfolio's return.In other words,one can create a portfolio with positive returns but less exposure to risk.

A sample of 26 years of S&P 500 index and a portfolio consisting of stocks of private prisons,which are believed to be negatively related to the S&P 500 index,is collected.A regression analysis was performed by regressing the returns of the prison stocks portfolio (Y)on the returns of S&P 500 index (X)to prove that the prison stocks portfolio is negatively related to the S&P 500 index at a 5% level of significance.The results are given in the following EXCEL output.

-Referring to Table 13-7,to test whether the prison stocks portfolio is negatively related to the S&P 500 index,the p-value of the associated test statistic is ________.

Definitions:

Substance Abuse

The harmful or hazardous use of psychoactive substances, including alcohol and illicit drugs, leading to addiction or dependence.

Older Adults

Older adults generally refer to individuals aged 65 and older, who may face unique health, social, and economic challenges.

Mutual Support

The encouragement and assistance shared between individuals or groups for mutual benefit.

Relapses

The return of a disease or the recurrence of problematic behaviors after a period of improvement or recovery.

Q76: True or False: Referring to Table 11-11,the

Q104: Referring to Table 12-13,suppose the value of

Q122: True or False: Referring to Table 11-5,if

Q141: True or False: In calculating the standard

Q162: True or False: Referring to Table 14-17,the

Q178: Referring to Table 14-15,which of the following

Q231: Referring to Table 14-14,the predicted mileage for

Q238: Referring to Table 14-6,_% of the variation

Q268: Referring to Table 14-17,which of the following

Q319: True or False: Referring to Table 14-7,the