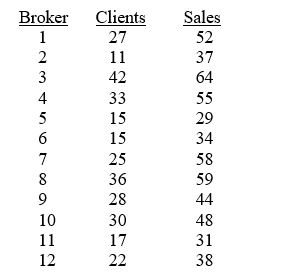

TABLE 13-4

The managers of a brokerage firm are interested in finding out if the number of new clients a broker brings into the firm affects the sales generated by the broker. They sample 12 brokers and determine the number of new clients they have enrolled in the last year and their sales amounts in thousands of dollars. These data are presented in the table that follows.

-Referring to Table 13-4, suppose the managers of the brokerage firm want to construct a 99% confidence interval estimate for the mean sales made by brokers who have brought into the firm 24 new clients. The confidence interval is from ________ to ________.

Definitions:

Limits To Arbitrage

Constraints or factors that prevent investors from correcting a mispriced asset, often due to costs, risks, or regulatory barriers.

Siamese Twin Companies

Refers to two companies that are listed and traded separately on stock exchanges but are operationally dependent on the same assets or operations.

Closed-end Funds

Type of investment fund with a fixed number of shares that trade on a stock exchange, unlike open-end funds that continuously issue new shares or redeem existing shares.

Behavioral Finance

Models of financial markets that emphasize implications of psychological factors affecting investor behavior.

Q15: Referring to Table 13-4,the managers of the

Q49: True or False: Referring to Table 13-11,the

Q64: In testing for differences between the median

Q77: True or False: Collinearity will result in

Q116: Referring to Table 12-13,how many children in

Q141: Referring to Table 13-11,which of the following

Q176: Referring to Table 13-4,the standard error of

Q195: Referring to Table 14-13,the predicted demand in

Q293: True or False: Referring to Table 14-15,there

Q331: True or False: Consider a regression in