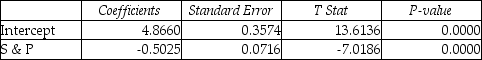

TABLE 13-7

An investment specialist claims that if one holds a portfolio that moves in the opposite direction to the market index like the S&P 500,then it is possible to reduce the variability of the portfolio's return.In other words,one can create a portfolio with positive returns but less exposure to risk.

A sample of 26 years of S&P 500 index and a portfolio consisting of stocks of private prisons,which are believed to be negatively related to the S&P 500 index,is collected.A regression analysis was performed by regressing the returns of the prison stocks portfolio (Y) on the returns of S&P 500 index (X) to prove that the prison stocks portfolio is negatively related to the S&P 500 index at a 5% level of significance.The results are given in the following EXCEL output.

-Referring to Table 13-7,to test whether the prison stocks portfolio is negatively related to the S&P 500 index,the appropriate null and alternative hypotheses are,respectively,

Definitions:

Team Tasks

Assignments or projects designated to be completed by a group working together.

Performance Potential

The capacity or ability of an individual or organization to achieve and maintain high levels of effectiveness and efficiency in their tasks or goals.

Complex

Composed of many interconnected parts or elements, denoting a system or problem that is difficult to understand, analyze, or solve.

Accepting Suggestions

The willingness to consider or adopt new ideas or recommendations from others.

Q10: Referring to Table 12-20,what are the lower

Q13: True or False: Referring to Table 13-11,the

Q17: Referring to Table 11-5,what should be the

Q24: The residual represents the discrepancy between the

Q27: True or False: Referring to Table 15-6,the

Q33: Referring to Table 11-3,the sporting goods retailer

Q41: True or False: Referring to Table 13-12,there

Q42: Referring to Table 14-19,what is the estimated

Q299: Referring to Table 14-8,_% of the variation

Q320: Referring to Table 14-11,what is the experimental