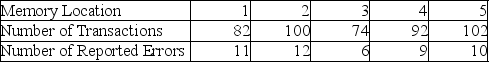

TABLE 12-4

A computer used by a 24-hour banking service is supposed to randomly assign each transaction to one of 5 memory locations. A check at the end of a day's transactions gave the counts shown in the table to each of the 5 memory locations, along with the number of reported errors.

The bank manager wanted to test whether the proportion of errors in transactions assigned to each of the 5 memory locations differ.

-Referring to Table 12-4, at 1% level of significance

Definitions:

Closing Entries

At the close of an accounting period, recordings are made to move balances from temporary accounts to those that are permanent.

Adjustment Columns

Special columns found in accounting ledgers and worksheets used for making necessary modifications to accounts at the end of a reporting period.

Depreciation Expense

The cost allocated over the useful life of a tangible asset to account for its decline in value due to use and time.

Accumulated Depreciation

The total depreciation for a fixed asset that has been charged to expense since the asset was acquired and available for use.

Q1: True or False: Referring to Table 11-10,the

Q17: Referring to Table 11-8,what are the degrees

Q19: Referring to Table 11-8,what is the value

Q25: Referring to Table 11-3,the null hypothesis that

Q34: Referring to Table 14-8,the analyst wants to

Q44: Referring to Table 13-11,what is the value

Q56: Referring to Table 11-1,at a significance level

Q67: Referring to Table 11-5,what are the numerator

Q99: Referring to Table 13-3,suppose the director of

Q135: The sample correlation coefficient between X and