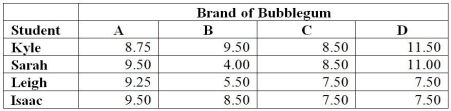

TABLE 11-11

A student team in a business statistics course designed an experiment to investigate whether the brand of bubblegum used affected the size of bubbles they could blow.To reduce the person-to-person variability,the students decided to use a randomized block design using themselves as blocks.

Four brands of bubblegum were tested.A student chewed two pieces of a brand of gum and then blew a bubble,attempting to make it as big as possible.Another student measured the diameter of the bubble at its biggest point.The following table gives the diameters of the bubbles (in inches) for the 16 observations.

-Referring to Table 11-11,the null hypothesis for the randomized block F test for the difference in the means is

Definitions:

Capital Loss Deduction

A tax deduction for losses incurred on the sale of an asset held for investment, allowing for the offset of capital gains or regular income up to certain limits.

Business Property

Assets and property owned by a business used in the operation and function of the business, including real estate, equipment, and intellectual property.

Casualty

A sudden, unexpected, or unusual event that causes damage or loss, often used in reference to natural disasters for tax deduction purposes.

Self-Employment Tax

This is a charge including Social Security and Medicare dues, principally aimed at those working independently.

Q2: Referring to Table 11-8,what are the degrees

Q9: Referring to Table 11-3,the value of MSA

Q77: True or False: The analysis of variance

Q88: Referring to Table 10-10,construct a 95% confidence

Q114: A survey claims that 9 out of

Q116: Referring to Table 12-13,how many children in

Q117: Referring to Table 10-8,construct a 99% confidence

Q140: Referring to Table 12-9,the degrees of freedom

Q143: Referring to Table 12-15,what should be the

Q154: Which of the following statements is not