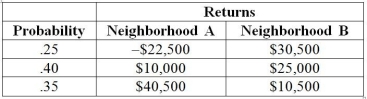

TABLE 5-7

There are two houses with almost identical characteristics available for investment in two different neighborhoods with drastically different demographic composition. The anticipated gain in value when the houses are sold in 10 years has the following probability distribution:

-Referring to Table 5-7, if your investment preference is to maximize your expected return and not worry at all about the risk that you have to take, will you choose a portfolio that will consist of 10%, 30%, 50%, 70%, or 90% of your money on the house in neighborhood A and the remaining on the house in neighborhood B?

Definitions:

Welfare Loss

Economic inefficiency resulting from a deviation from an optimal allocation of goods and services, often due to externalities or market power.

Net Social Gain

The overall benefit to society from an economic transaction, after subtracting costs.

Barriers To Entry

Factors that make it difficult for new competitors to enter a market.

Net Social Cost

The total monetary cost of the negative externalities produced by an activity or production, minus any benefits.

Q23: True or False: If P(A or<br>B)= 1.0,then

Q59: The employees of a company were surveyed

Q72: The collection of all possible events is

Q96: The interval between patients arriving at an

Q97: A manufacturer of power tools claims that

Q104: Suppose that past history shows that 60%

Q113: Referring to Table 2-12,construct a table of

Q117: The closing price of a company's stock

Q121: Referring to Table 6-3,what is the probability

Q161: True or False: In a Poisson distribution,the