Silver Prices

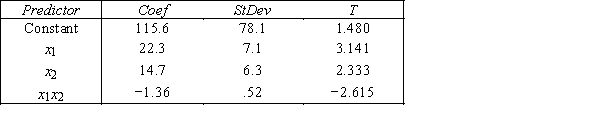

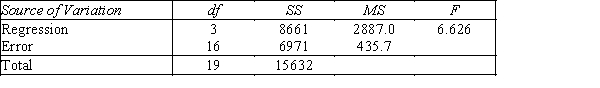

An economist is in the process of developing a model to predict the price of silver.She believes that the two most important variables are the price of a barrel of oil (x1)and the interest rate (x2).She proposes the first-order model with interaction: y = β0 + β1x1 + β2x2 + β3x1x3 + ε.A random sample of 20 daily observations was taken.The computer output is shown below. THE REGRESSION EQUATION IS y = 115.6 + 22.3x1 + 14.7x2− 1.36x1x2  S = 20.9 R−Sq = 55.4% ANALYSIS OF VARIANCE

S = 20.9 R−Sq = 55.4% ANALYSIS OF VARIANCE

-{Silver Prices Narrative} Interpret the coefficient b1.

Definitions:

Influencing

The capacity to have an effect on the character, development, or behavior of someone or something, or the effect itself.

Manipulating

Influencing or controlling someone or something to one's advantage, often in an unfair or dishonest way.

Motivating

The process of providing reasons, incentives, or encouragement to act or behave in a specific manner.

Indirect Strategy

Indirect strategy in communication involves presenting the supporting reasons before the main message or request, often used to prepare the recipient and reduce resistance.

Q7: {Assembly Line Narrative} Construct the p chart.

Q11: We can often detect autocorrelation by graphing

Q18: Error terms that are correlated over time

Q19: The Friedman test is always:<br>A) one-tail with

Q19: Error terms that are autocorrelated _ (are/are

Q58: Which of the following statements is

Q83: Which of the following assumptions concerning the

Q124: {25 Samples Production Narrative} Is the process

Q185: The fairly regular fluctuations that occur within

Q224: If the coefficient of correlation is 0.90,then