Returns on Investment

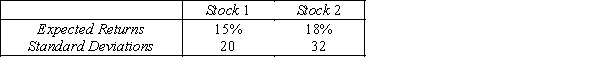

An analysis of the stock market produces the following information about the returns of two stocks.  Assume that the returns are positively correlated with correlation coefficient of 0.80.

Assume that the returns are positively correlated with correlation coefficient of 0.80.

-{Returns on Investment Narrative} Find the mean of the return on a portfolio consisting of an equal investment in each of the two stocks.

Definitions:

Coercive

Relating to or using force or threats to persuade someone to do something or to achieve compliance.

Uncommunicative

Lacking the willingness or ability to talk or share information.

Vulnerable

A state of being open to harm, damage, or exploitation due to a lack of protection or strength.

Balance of Probabilities

The standard of evidence in civil trials, where a case is decided in favor of the party whose claim is more likely to be true.

Q4: {Longevity and Salary Narrative} Draw the scatter

Q11: Scatter diagrams,covariance,and the coefficient of correlation are

Q32: _ error is due to mistakes made

Q69: Given that Z is a standard normal

Q97: {Ages of Senior Citizens Narrative} Explain why

Q130: The mean of the standard normal distribution

Q149: The number of customers arriving at a

Q158: Tanner took a statistics test whose mean

Q161: If your golf score is 3 standard

Q217: If A and B are independent events