Returns on Investment

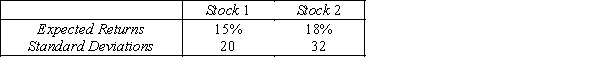

An analysis of the stock market produces the following information about the returns of two stocks.  Assume that the returns are positively correlated with correlation coefficient of 0.80.

Assume that the returns are positively correlated with correlation coefficient of 0.80.

-{Returns on Investment Narrative} Suppose that you wish to invest $1 million.Discuss whether you should invest your money in stock 1,stock 2,or a portfolio composed of an equal amount of investments on both stocks.

Definitions:

Leasing Agreement

A contract where one party agrees to rent property owned by another party for a specified time period in exchange for payment.

Capital Markets

Financial markets in which long-term debt or equity-backed securities are bought and sold, serving as a platform for raising capital.

Long-Term Bonds

Bonds that are due for payment or redemption at a date more than ten years in the future, often offering a higher yield due to the increased risk.

Stocks

Shares of ownership in a company, giving shareholders a claim on the company’s earnings and assets.

Q5: Given a Poisson random variable X,where the

Q23: A sample of size 200 is taken

Q35: If the correlation coefficient r = 1.00,then

Q40: The number of customers making a purchase

Q78: {Cysts Narrative} What is the probability that

Q91: If two events are mutually exclusive,what is

Q116: Posterior probabilities can be calculated using the

Q124: {Business Majors Narrative} What is the chance

Q129: {Number of Birds Narrative} Compute the mean

Q150: If X and Y are two