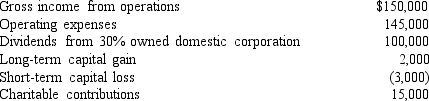

Monroe Corporation reported the following results for the current year:  Included in the above is $5,000 of qualified production activities income. In addition, Monroe Corporation has a $5,000 NOL carryforward from last year. How much can Monroe Corporation take as a charitable contribution deduction in the current year?

Included in the above is $5,000 of qualified production activities income. In addition, Monroe Corporation has a $5,000 NOL carryforward from last year. How much can Monroe Corporation take as a charitable contribution deduction in the current year?

Definitions:

Auctioneer

A person who conducts sales at auctions by accepting bids and declaring goods sold.

Highest Bid

The highest price offered by a bidder at an auction or in a competitive bidding process.

Firm Offer

A rule that no consideration is necessary when a merchant agrees in writing to hold an offer open for the sale of goods.

Consideration

The value (such as money, a promise, or an act) exchanged between parties in a contract.

Q9: What are three differences between ion channels

Q9: E.coli is known as a gram-negative bacterial

Q16: All of the following are acceptable conventions

Q24: Sanjuro Corporation (a calendar-year corporation) purchased and

Q40: Maui Corporation makes two distributions during the

Q41: The entity concept of a partnership views

Q69: Michael was a partner in the M&M

Q69: Reduction for personal use

Q101: In 2018, the corporate tax rate is:<br>A)

Q104: Corporation P owns 100 percent of Corporation