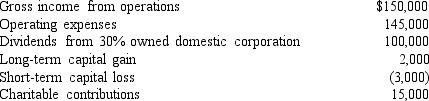

Monroe Corporation reported the following results for the current year:  In addition to the above, Monroe Corporation has a $5,000 NOL carryforward available from last year. What is Monroe Corporation's taxable income for the current year?

In addition to the above, Monroe Corporation has a $5,000 NOL carryforward available from last year. What is Monroe Corporation's taxable income for the current year?

Definitions:

Managing Relationships

The process of developing, maintaining, and enhancing interactions with individuals or groups to achieve desired outcomes and foster mutual respect.

Educator Expense Deduction

The Educator Expense Deduction allows eligible educators to deduct unreimbursed expenses for classroom supplies, up to a specified amount annually.

Eligible Educator

A teacher or educational professional who meets certain criteria and may qualify for specific tax deductions or benefits.

Student Loan Interest

The cost paid for borrowing money for education, which can sometimes be deductible on federal taxes.

Q5: A compound containing N-acetylneuraminic acid (sialic acid)is:<br>A)cardiolipin.<br>B)ganglioside

Q22: Marvin sold his sister, Sue, some stock

Q28: To determine the tax, a taxpayer with

Q41: The entity concept of a partnership views

Q48: Draw the structure of a biological membrane

Q60: Melody works in her home using a

Q77: Home office expenses that exceed the income

Q83: Sam's land was condemned for a sewage

Q84: Lopez Corporation sold equipment that it had

Q89: Jose, who is single, is allocated $510,000