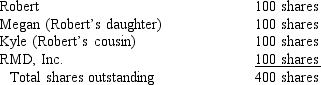

The outstanding stock of Riccardo Corporation is owned as follows:  Robert owns 50% of RMD, Inc. stock. The rest of RMD, Inc. stock is owned by unrelated parties. Riccardo Corporation redeems 90 of Robert's shares of stock for $9,000 in the only redemption transaction this year. Robert's basis for his stock is $10 per share (100 shares @ $10 = $1,000) . Riccardo Corporation has $300,000 in E&P. How much capital gain or dividend income does Robert recognize as a result of this redemption?

Robert owns 50% of RMD, Inc. stock. The rest of RMD, Inc. stock is owned by unrelated parties. Riccardo Corporation redeems 90 of Robert's shares of stock for $9,000 in the only redemption transaction this year. Robert's basis for his stock is $10 per share (100 shares @ $10 = $1,000) . Riccardo Corporation has $300,000 in E&P. How much capital gain or dividend income does Robert recognize as a result of this redemption?

Definitions:

Diversity of Opinion

The presence of varied viewpoints and perspectives within a group, which can enhance decision-making and creativity but also lead to conflicts.

External Change

Modifications or adjustments that occur outside an organization, which can impact its operations and strategies.

Management Philosophy

Relates to the set of beliefs and principles that guide the decision-making, strategies, and leadership practices of a manager or organization.

Type of Business

Categories or classifications of commercial organizations based on factors like ownership, size, and product or service rendered.

Q7: On June 20, 2018 Baker Corporation (a

Q9: The lease inclusion amount increases the deduction

Q15: Distinguish between simple diffusion (SD),facilitated diffusion (FD),and

Q28: Enzymes are biological catalysts that enhance

Q36: A corporation that owns 72 percent of

Q53: Willy is involved in a number of

Q102: A fiduciary tax return must be filed

Q110: The basis limitation rules are applied before

Q115: For transportation expenses for foreign travel of

Q131: A sole proprietor:<br>A) deducts his or her