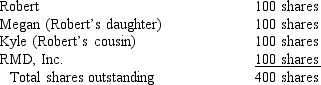

The outstanding stock of Riccardo Corporation is owned as follows:  Robert owns 50% of RMD, Inc. stock. The rest of RMD, Inc. stock is owned by unrelated parties. Riccardo Corporation redeems 90 of Kyle's shares of stock for $9,000 in the only redemption transaction this year. Kyle's basis for his stock is $10 per share. Riccardo Corporation has $300,000 in E&P. What is Kyle's total basis in his remaining 10 shares of stock after the redemption?

Robert owns 50% of RMD, Inc. stock. The rest of RMD, Inc. stock is owned by unrelated parties. Riccardo Corporation redeems 90 of Kyle's shares of stock for $9,000 in the only redemption transaction this year. Kyle's basis for his stock is $10 per share. Riccardo Corporation has $300,000 in E&P. What is Kyle's total basis in his remaining 10 shares of stock after the redemption?

Definitions:

Market Value

The cost at which a property would be sold in a competitive bidding environment.

Annual Dividend

Annual dividend is the total dividend payment a shareholder receives from a company in a fiscal year.

Standard Deviation

A measure of the dispersion or variability around the mean of a set of data, often used in finance to assess investment risk.

Expected Rate

An anticipated return on investment, interest rate, or growth rate based on historical data, market analysis, or other predictive models.

Q10: Who is a disqualified person?

Q13: Bobbie, age 10, has $6,000 in interest

Q15: What is the effect of a double

Q46: The all events test is met for

Q46: What functional groups are present on this

Q50: What effect do liabilities assumed by the

Q54: (a)On the reaction coordinate diagram shown

Q72: In 2017, a personal theft loss could

Q78: Victoria is a 50 percent partner in

Q110: Alternative depreciation system