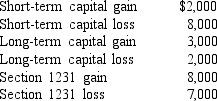

During the current year, Zach had taxable income of $100,000 before considering the following property transactions:  Two years ago Zach had a $4,000 gain from the sale of a Section 1231 asset but last year Zach had no capital or Section 1231 gains or losses. What effect will the above property transactions have on Zach current taxable income and will there be any carryforward or carryback of gains or losses?

Two years ago Zach had a $4,000 gain from the sale of a Section 1231 asset but last year Zach had no capital or Section 1231 gains or losses. What effect will the above property transactions have on Zach current taxable income and will there be any carryforward or carryback of gains or losses?

Definitions:

Monosodium Glutamate (MSG)

A sodium salt of glutamic acid, used as a flavor enhancer in foods, with its safety being subject to debate.

Toxic Effects

Harmful impacts on an organism or cell caused by substances or environmental factors, often leading to damage or dysfunction.

Neurons

Specialized cells in the nervous system that transmit information to other nerve cells, muscle, or gland cells through electrical and chemical signals.

Homeostatic Hormone

One of a group of hormones that maintain internal metabolic balance and regulate physiological systems in an organism.

Q12: Craig and Sally, a married couple, file

Q24: Sanjuro Corporation (a calendar-year corporation) purchased and

Q32: In determining consolidated net income, each corporation

Q36: What types of insurance premiums are deductible

Q45: Sonja is a talented 18 year-old dancer

Q56: Qualified deferred compensation plans have the following

Q74: A corporate net operating loss incurred in

Q93: What is the purpose of the alternative

Q111: Sales taxes levied on the purchase of

Q115: For transportation expenses for foreign travel of