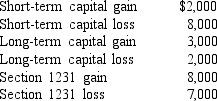

During the current year, Zach had taxable income of $100,000 before considering the following property transactions:  Two years ago Zach had a $4,000 gain from the sale of a Section 1231 asset but last year Zach had no capital or Section 1231 gains or losses. What effect will the above property transactions have on Zach current taxable income and will there be any carryforward or carryback of gains or losses?

Two years ago Zach had a $4,000 gain from the sale of a Section 1231 asset but last year Zach had no capital or Section 1231 gains or losses. What effect will the above property transactions have on Zach current taxable income and will there be any carryforward or carryback of gains or losses?

Definitions:

Trust

Trust is the reliance on the integrity, strength, ability, or character of a person or thing, foundational to building relationships and effective communication.

Lewicki And Tomlinson

Scholars known for their contributions to the field of negotiation, specifically in identifying and analyzing negotiation strategies.

Types Of Trust

Various forms of reliance or confidence between entities, such as emotional trust, contractual trust, or competence trust.

Interactional Justice

The perceived fairness of the interpersonal treatment received during the execution or implementation of agreements or decisions.

Q1: Fernando was a one-third shareholder in Rodriguez,

Q11: On October 12, 2018, Wilson Corporation (a

Q20: Sonjay had AGI of $60,000 in 2018

Q30: On November 1, 2018, Hernandez Corporation (a

Q40: $20,000 transferred into Crummy trust with gift

Q46: In a qualified reorganization:<br>A) Gain is generally

Q55: An abandoned spouse must only live apart

Q64: Sanjuro Corporation (a calendar-year corporation) purchased and

Q81: A person who qualifies for the foreign

Q91: Cliff owned investment stock purchased three years