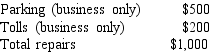

Haley, a self-employed individual, drove her automobile a total of 20,000 business miles in 2018. This represents about 75% of the auto's use. She has receipts as follows:  If Haley uses the standard mileage rate method, how much can she deduct as a business expense?

If Haley uses the standard mileage rate method, how much can she deduct as a business expense?

Definitions:

Planned Activity Level

The expected volume of production or sales used in budgeting and decision-making processes.

Machine Hours

A measure of the amount of time a machine is operated, used for allocating manufacturing costs.

Flexible Budget Total

A financial plan that adjusts or varies with changes in the volume of activity or business.

Direct Labor Hours

The total hours of labor directly involved in producing goods or services, often used as a basis for allocating overhead costs.

Q33: The Bogtown Corporation owns a 20-year old

Q46: If a health plan is self-insured, highly-compensated

Q49: Five years ago, Devin Corporation granted Laura

Q70: YumYum Corporation (a calendar-year corporation) moved into

Q79: What is the standard deduction for a

Q85: Crispen Corporation can invest in a project

Q92: There are three basic taxable entities: the

Q114: Qualified dividends are dividends that are eligible

Q116: $200 interest on a loan that was

Q126: Tighe won a new automobile from his