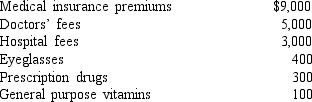

Camila, age 60, is single and has adjusted gross income of $100,000. She paid (with after-tax dollars) the following medical expenses in 2018:  She received only $2,000 in reimbursements from her insurance company for her medical expenses. How much can Camila deduct for medical expenses in 2018 if she has $30,000 of other itemized deductions?

She received only $2,000 in reimbursements from her insurance company for her medical expenses. How much can Camila deduct for medical expenses in 2018 if she has $30,000 of other itemized deductions?

Definitions:

Government Ownership

The possession and control of enterprises, assets, or property by a governmental body or authority, rather than private individuals or companies.

Q3: A parent cannot be considered as a

Q13: Health insurance premiums that are deductible as

Q16: The most common ordinary income assets are

Q19: Which of the following are included in

Q26: A high DIF score indicates which of

Q28: Which of the following best describes vertical

Q30: If the due date for a tax

Q91: Sanjuro Corporation (a calendar-year corporation) purchased and

Q96: An employee who receives a nonqualified stock

Q117: Which of the following filing statuses can