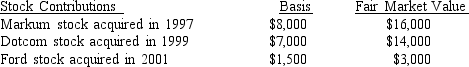

What is Beth's maximum allowable deduction for the following contributions to qualified public charities during the current year if her adjusted gross income is $90,000?

Definitions:

Myers-Briggs Test

A psychological assessment that categorizes individuals into personality types based on their preferences in perceiving the world and making decisions.

Aptitude

A natural ability to do something or to learn something.

Personality Test

A questionnaire or other standardized instrument designed to reveal aspects of an individual's character or psychological makeup.

Self-Esteem

An individual's subjective evaluation of their own worth or value.

Q6: What are the steps that are usually

Q58: Which of the following statements is correct?<br>A)

Q75: Gain on the sale of a machine

Q75: ABC Corporation awarded John 1,000 options in

Q76: Determine the amount of the capital gain

Q82: Child support received

Q93: Expenses for a vacation home rented for

Q97: Tom, a calendar-year taxpayer, worked in Japan

Q103: Alpha Corporation had income from operations of

Q108: When may a CPA use estimates in