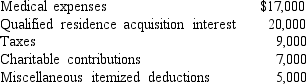

Samuel, a single individual, has adjusted gross income of $150,000 and the following itemized deductions before applicable floor limitations for 2018:  What are Samuel's itemized deductions for alternative minimum tax purposes?

What are Samuel's itemized deductions for alternative minimum tax purposes?

Definitions:

Same Sex

Pertaining to a relationship or attraction between two individuals of the same gender.

Cross-Sectional Research

A research method that analyzes data from a population, or a representative subset, at a specific point in time to examine relationships between variables.

Longitudinal Research

A study design that involves repeated observations of the same variables over a period of time, often years or even decades.

Intelligence Levels

Varying degrees of cognitive capacity among individuals, including problem-solving, learning, adaptation, and understanding complex concepts.

Q10: The following properties have been owned by

Q28: Which is more advantageous, a deduction for

Q42: Prior to 2018, what relocation expenses are

Q43: Which of the following types of returns

Q51: Emma owns 40% of Johnson, Inc., a

Q84: Four shareholders form a new corporation in

Q86: All of the following are retirement plans

Q86: Eduardo filed his 2017 tax return on

Q92: Contrast business investigation, start-up, and organization expenses.

Q94: The type and degree of connection between