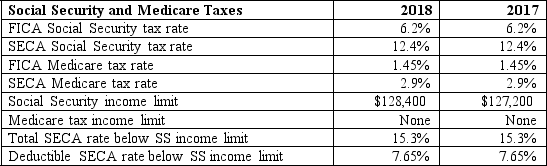

Warren has $62,400 of net income from his sole proprietorship. How much is his self-employment tax on this income in 2018?

Definitions:

Subscriptions Receivable

An amount owed by customers for subscription services or products that have been provided but not yet paid for.

Paid-in Capital

Paid-in capital is the amount of money that a company has received from shareholders in exchange for shares of stock, reflecting the capital that has been invested in the company beyond its par value.

Common Stock Subscribed

A commitment by investors to purchase shares of a company's common stock, where the shares are reserved for the subscribers until payment is made.

Dividends in Arrears

Dividends on preferred shares that have not been paid in the scheduled time, accruing until they are paid out.

Q6: What are the steps that are usually

Q12: Perez Corporation paid the following expenses: $14,000

Q27: All of the following are part of

Q32: During 2018, Jones Corporation paid Joshua a

Q36: Geraldine worked in the produce section of

Q41: What limitations are placed on the deductibility

Q42: Which of the following business entities has

Q51: Cash dividends from a U.S. corporation paid

Q104: Which of the following statements is true

Q112: Cailey and Dimitri are married and file