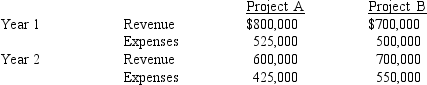

Berman Corporation can accept only one of two projects. The revenue and expenses for each of the projects is shown below. Which project should Berman accept if the corporation has a 10 percent cost of capital and a 21 percent marginal tax rate?

Definitions:

Income Statement Data

Financial information that summarizes a company's revenues, expenses, and profits over a specific period.

Operating Expenses

Costs incurred in the day-to-day operations of a business, excluding direct material and labor costs related to the production of goods or services.

Cost of Goods Sold

The total cost associated with making or acquiring any goods sold during a reporting period, including material, labor, and overhead costs.

Gross Profit

The financial profit a company makes after subtracting the cost of goods sold from total sales revenue.

Q2: George took a customer to dinner where

Q3: _ is automatic and starts as soon

Q11: Computers use _ language to process data

Q13: _ addressing means that the IP address

Q15: U.S. copyright lasts for the creator's life

Q39: What is the difference between a letter

Q99: What are the rules regarding the deduction

Q99: All stock dividends are nontaxable.

Q100: Jerry and Matt decide to form a

Q113: Explain the difference in benefits between a